MAKE A GIFT

Support The Hormel Institute with a gift today!

Give online by clicking the “Give” links below or by mailing your gift to The Hormel Institute, 801 16th Ave. NE, Austin, MN, 55912

The Hormel Institute is deeply grateful for each donation that advances innovative cancer research.

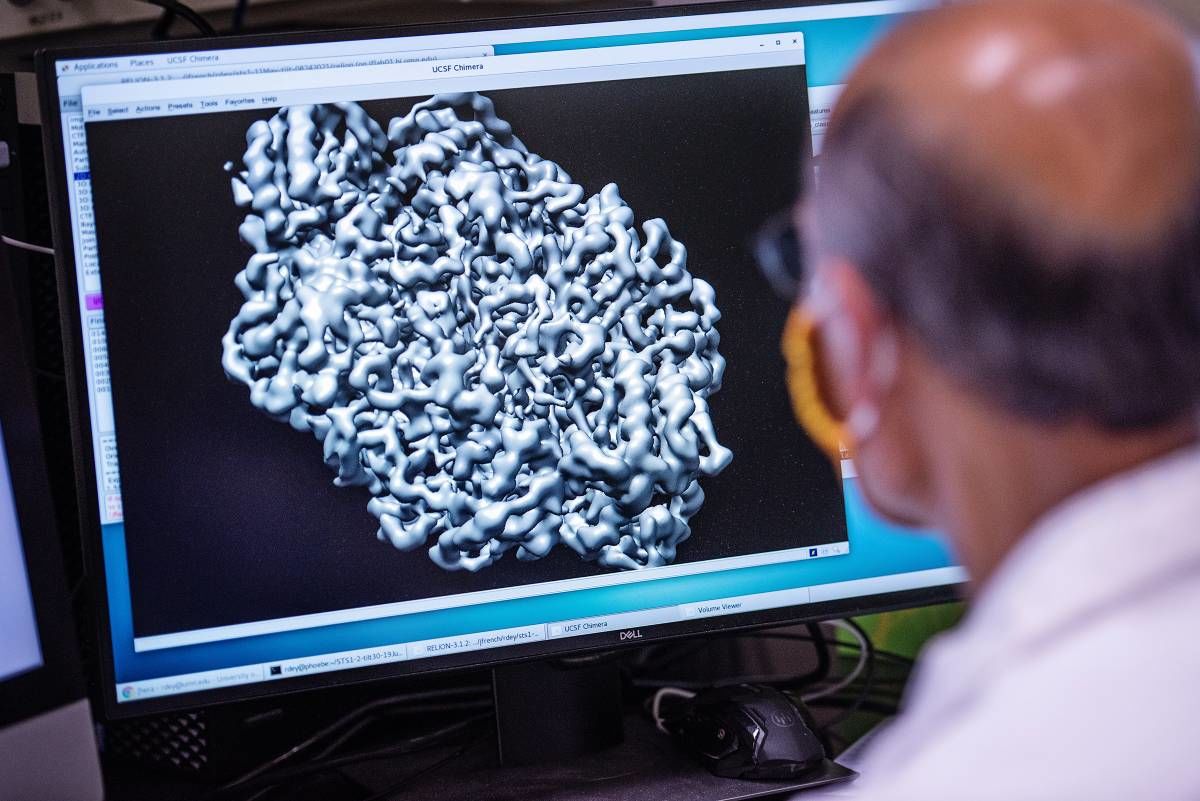

Every dollar advances answers. Research is the only answer to cancer, and your important gift helps our world-renowned scientists continue to make progress in the fight against cancer.

Thank you for joining us on the front line with your gifts to biomedical research as we seek discoveries so people can live longer, healthier lives.

100% of each donation to The Hormel Institute directly funds research here in Austin, Minnesota, thanks to the support of The Hormel Foundation.

General Research Fund

This fund supports general research projects or equipment that benefits the overall research mission of The Hormel Institute.

Breast Cancer Fund

This fund supports innovative research to find new and better ways to treat and prevent breast cancer.

Prostate Cancer Fund

This fund supports accelerating research discoveries to better prevent, detect and treat prostate cancer.

Facility Improvement Expansion Fund

This fund supports the acquisition of state-of-the-art, global communication technologies for The Hormel Institute’s new Live Learning Center to accelerate cancer research discoveries and foster scientific collaborations worldwide.

Education Fund

This fund supports current and future education initiatives for student opportunities at The Hormel Institute.

Other Options to Give

Send your gift to:

The Hormel Institute

801 16th Ave NE

Austin, MN 55912

For more information about giving to The Hormel Institute, contact: Gail Dennison, Director of Development and External Relations, gaildenn@umn.edu, 507-437-9604; Brenna Gerhart, Development Associate, bgerhart@umn.edu, 507-437-9601

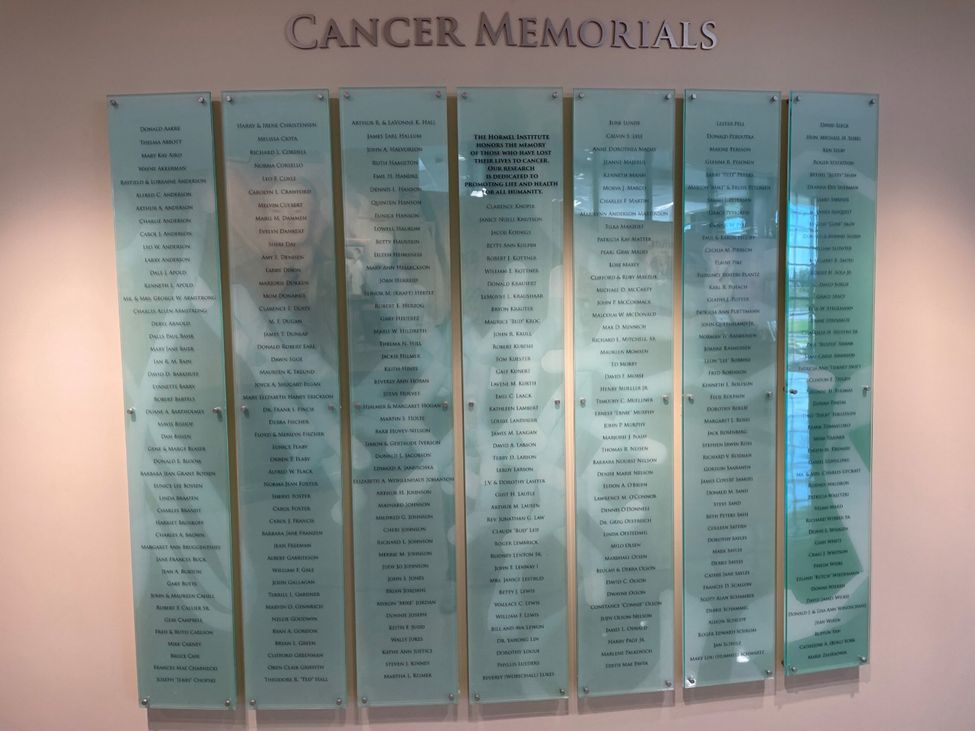

Our Cancer Memorial Wall

The Cancer Memorial Wall recognizes those who have lost their battle with cancer and whose family and friends have given memorial research funds to The Hormel Institute. The Cancer Memorial Wall is an important reminder to all of us of why we are here every day working to find new discoveries to fight this terrible disease.